Filing for Bankruptcy While Keeping Your Home and Car

When you can no longer keep up with your debts, bankruptcy offers a legal process for achieving financial stability and a new start. Many people fear losing their belongings in a bankruptcy because under a Chapter 7 bankruptcy, many of the debtor’s assets are sold to pay their creditors. But what people who have never been through bankruptcy often don’t understand is that many assets are exempted from liquidation during bankruptcy.

Yes, in many cases, you can keep your house and car when filing for bankruptcy in Ohio. However, the bankruptcy filing process is complex. And, though bankruptcy is your legal right if you qualify, it may not be the correct option for you.

If you are unable to pay your debts or it is increasingly difficult to keep up with what you owe, you should consult an experienced and compassionate personal bankruptcy attorney about what’s best for you.

In Ohio, Amourgis & Associates, Attorneys at Law, can help you explore whether filing for bankruptcy is the best option for you and understand which exemptions apply in your bankruptcy case. Our discussion below is Ohio-specific and designed to help residents make informed decisions.

Contact Amourgis & Associates today for a free initial consultation with one of our Ohio bankruptcy lawyers.

Understanding Personal Bankruptcy: Which Chapter Applies?

Bankruptcy is a legal process that lets individuals who have debt they can no longer afford make a fresh financial start. The various types of bankruptcy are referred to as “chapters” because their specific protections and requirements are spelled out in individual chapters of the U.S. Bankruptcy Code.

Most individuals pursue bankruptcy under Chapter 7 if they are insolvent or Chapter 13 if they have too much disposable income to qualify for Chapter 7.

Chapter 7 bankruptcy is known as “liquidation” bankruptcy because the debtor’s non-exempt property is sold to pay creditors. Once eligible creditors are paid, the Bankruptcy Court will “discharge,” or forgive, most of the debtor’s unsecured debts and some secured debts.

Unsecured debt includes credit card debt, student loans, personal loans, and medical bills. Secured debt refers to assets that can be seized for nonpayment, such as a car or home.

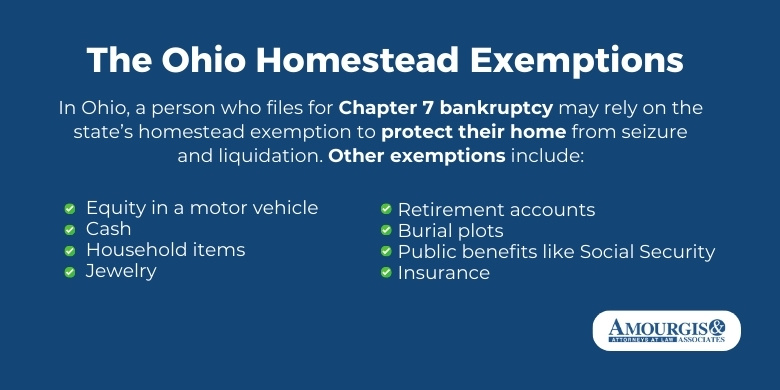

But a debtor in Chapter 7 bankruptcy can also keep certain exempt assets. They include the debtor’s primary residence, household goods, a motor vehicle (up to a certain value), and retirement accounts.

Under Chapter 13 bankruptcy, which is known as a “reorganization,” the debtor submits a plan to pay all or a portion of their debt over a three- to five-year period. Under that plan, which the Court must approve, the debtor proposes making payments to a bankruptcy trustee, who in turn distributes those funds to creditors. After the debtor complies with the debt repayment plan, the Court discharges any remaining dischargeable debts.

Can You Keep Your House and Car in Bankruptcy?

We are always happy to tell clients, “Yes, you can keep your house after you file for bankruptcy.” In most cases, the answer is also “Yes, you can keep your car while in bankruptcy.”

Here’s how you keep your home and vehicle in bankruptcy:

- Under Chapter 7 bankruptcy in Ohio, the debtor may keep their primary residence if they have up to $182,625 in home equity. (The figures shown here and below are for April 2025 through March 2028; Ohio property exemptions are adjusted every three years.)

Home equity is the difference between your property’s tax value and what you owe on the mortgage. For example, if your house is worth $400,000 and your loan balance is $250,000, then you have $150,000 worth of equity in your home.

- Under Chapter 7 bankruptcy in Ohio, the debtor may keep their primary vehicle if it is worth $5,025 or less.

- Under Chapter 13 bankruptcy in Ohio, the debtor may retain their primary residence and vehicle, provided they are current on all outstanding mortgage or loan payments.

Ohio property exemptions also allow you to exempt and retain in bankruptcy:

- Cash up to $625

- One household item worth $800 or multiple household items worth up to $16,850 in aggregate

- Jewelry worth up to $2,125

- Professional books or trade tools worth up to $3,200

- Money awarded for a bodily injury up to $31,650

- All wages

- All money in retirement and pension plans

- Up to $1,675 of value in any property.

The final “wild card” exemption of up to $1,675 of the debtor’s aggregate interest in “any” property may be applied as needed. This may help you keep property not otherwise exempted, or for example, you could apply it to your vehicle if its value exceeds the standard motor vehicle exemption.

What Happens to Your House in Bankruptcy?

Under Ohio bankruptcy law, you will be able to keep your primary residence — your home — after filing for bankruptcy if:

- You file Chapter 7, and your home equity does not exceed the limit established by Ohio law, or

- You file Chapter 13, and you are current on your mortgage payments.

Your home may be at risk if you have high equity and are filing under Chapter 7, or if you are behind on payments and filing Chapter 13 bankruptcy.

Suppose your home does not qualify for exemption from bankruptcy proceedings. In that case, Amourgis & Associates may be able to help you negotiate a reaffirmation agreement with your mortgage holder, allowing you to keep your home. Similarly, a redemption may allow you to keep your car.

A reaffirmation agreement is a contract between a debtor and a creditor in which the debtor agrees to repay all or part of a debt that would otherwise be discharged in bankruptcy. The Bankruptcy Court judge overseeing your case must approve a reaffirmation agreement.

In a Chapter 7 bankruptcy, you may be able to redeem some personal property, such as your car, and keep it.

With a redemption, the debtor pays off the secured portion of a loan, which reduces the balance and monthly payments, and allows them to keep the property. For example, to redeem a vehicle worth $10,000 with an original car loan of $15,000, the debtor would pay the lender $10,000 to pay off the secured portion of the debt. The remaining $5,000 balance would then be treated as unsecured debt, which, depending on the details of the individual’s bankruptcy, could be discharged at the conclusion of the case.

Redemptions apply to personal property, such as cars, household appliances, and anything else used by the debtor or their household. A redemption cannot be applied to real property (i.e., homes or other structures or land).

Common Bankruptcy Scenarios for Ohio Residents:

- Example 1: Homeowner with $120,000 equity and current on mortgage → Keeps house

- Example 2: Vehicle with $2,500 equity and current on car loan → Keeps car

- Example 3: Behind on car loan, but files Chapter 13 → Keeps car via repayment

- Example 4: Car worth more than the Ohio exemptions limit in Chapter 7 → Lawyer helps negotiate a redemption

Everyone’s situation is different, but in Ohio, a bankruptcy lawyer from Amourgis & Associates can explain the options available to you and help you obtain the best possible outcome.

Contact the Ohio Bankruptcy Lawyers at Amourgis and Associates

If you’re considering filing for bankruptcy, it is crucial to hire an experienced bankruptcy lawyer to help you protect as much of your property and financial assets as possible. In Ohio, a bankruptcy attorney at Amourgis & Associates, Attorneys at Law, can advise you about protecting your home, car, and other assets during bankruptcy.

We can help you determine what types of bankruptcy you qualify for and which one best suits your financial circumstances. We’ll also explore alternatives to bankruptcy, such as credit and personal financial counseling, loan modification, and debt consolidation.

Contact us today for a free consultation with an experienced Ohio bankruptcy attorney and learn more about protecting your home and car when bankruptcy is right for you.